GST Registration Services

Learn how to register for GST online in Delhi,India

Luxefinalyzer is a popular Tax Consultancy service Provider company in Delhi for GST Law consulting services, GST registration, GST compliances and GST return filing.

Qualified GST Consultancy To Get GST Registration Expert Help

Find information about GST registration Process, GST registration Plans, GST registration Procedure, documents Required and GST registration process fees

GST Registration Overview

GST stands for Goods and Services Tax, which is a value-added tax levied on the supply of goods and services in India. GST was implemented in India on July 1, 2017, and replaced several indirect taxes such as excise duty, service tax, and value-added tax.

Any person or business engaged in the supply of goods or services whose turnover exceeds the threshold limit specified under the GST law is required to register for GST. The threshold limit for GST registration varies based on the type of business and the state in which it is located.

For most businesses in India, the threshold limit for GST registration is an annual turnover of Rs. 20 lakhs. However, for businesses in special category states such as Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, and Uttarakhand, the threshold limit is Rs. 10 lakhs. For businesses engaged in the supply of goods, the threshold limit for GST registration is Rs. 40 lakhs in some states.

It is important to note that even if a business's turnover is below the threshold limit, it may still choose to register for GST voluntarily. This can be beneficial if the business wants to claim input tax credit or if it wants to expand its business to other states in India.

At Luxe Finalyzer, we understand that navigating the complexities of GST registration can be daunting for businesses of all sizes. That's why we offer expert and hassle-free GST registration services to ensure that your business is compliant with the latest tax regulations.

Our team of seasoned professionals has extensive experience in handling GST registrations for a wide range of industries. We work closely with our clients to understand their business requirements and offer tailored solutions to ensure that they are GST compliant.

Whether you are a small start-up or a large enterprise, our team will assist you in every step of the way, from obtaining the necessary documents to filing your GST returns. We also provide ongoing support and advice to help you maintain compliance with the latest GST regulations.

So why choose Luxe Finalyzer for your GST registration needs? Here are some of the benefits that you can expect:

Hassle-free registration process

Expert advice and support from our experienced team

Customized solutions to meet your business needs

Timely and accurate filing of GST returns

Ongoing support to maintain compliance with GST regulations

Documents Required For gst Registration

For Proprietorship Firm

1. Name and Nature of Firm

2. Proprietor’s PAN card

3. Aadhar Card

4. Bank Statement / Cancelled Cheque

5. Photographs

6. Electricity Bill

7. Rent Agreement / NOC

For LLP & Partnership Firm

1. Partnership deed / LLP Certificate2. Pan Card of Firm

3. Pan Card of Partners

5. Aadhar Card of Partners

6. Photographs of Partners

7. Authorisation Letter

8. Bank Statement / Cancelled Cheque

9. Electricity Bill, Rent Agreement/ NOC

For Pvt. Ltd. /Public Ltd./OPC

1. Incorporation Certificate2. Pan Card of Company

3. Pan Card of Directors

5. Aadhar Card of Directors

6. Photographs of Directors

7. Authorisation Letter

8. Bank Statement / Cancelled Cheque

9. Electricity Bill, Rent Agreement

Eligibility Criteria for GST Registration

- If You have an annual turnover limit above Rs.20 lakh for your intrastate business

- If you own an e-commerce business

- If you own an inter-state business

- If you are required to pay tax under reverse charge

- If you are required to pay tax under Section 9, sub-section (5)

- You are a non-resident liable to pay taxes producing taxable supply

How to register for GST

- Use your PAN, email ID and mobile number to fill out GST REG-01 and submit the same

- Verify your mobile number and email ID with a one-time password after PAN verification

- Store the TRN Number sent to your mobile number and email ID after verification is complete

- Put in your TRN number and attach supporting documents where required

- Fill out the GST REG-03 form BY Loging through TRN no. with all required information & documents

- After verification of all information submitted, a certificate of registration will be issued to you within 3 working days

Get a Free Consultation Today!

Any Queries? or Require any Assistance? Get In Touch With Our In House Experts who are there to guide you and help you for all your Financial and Tax related queries.

You may like other services we offer

Nidhi Company Registration

Get Nidhi Company Registration in Delhi

APEDA Registration

Get APEDA Registration in Delhi

Trust Registration

Get Trust Registration in Delhi

Bar License

Get Bar Licensen in Delhi

Shop Act Establishment

Get Shop & Establishment Registration in Delhi

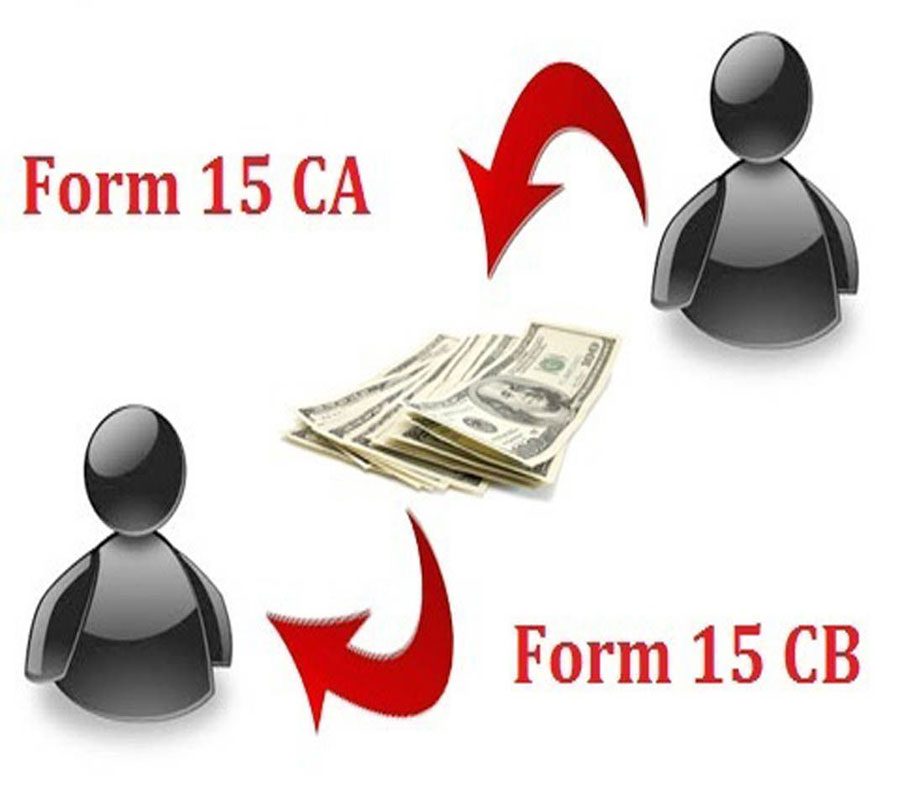

REMITANCE FILLING FORM 15CA...

Get Proprietorship Firm Registration in Delhi

V-sign Digital Signature Ce...

Get V-sign Digital Signature Franchise in Delhi and Pan India

.png)

Partner

Partner